TRIANGLE MASTERCARD REVIEW: Is It Worth Applying For?

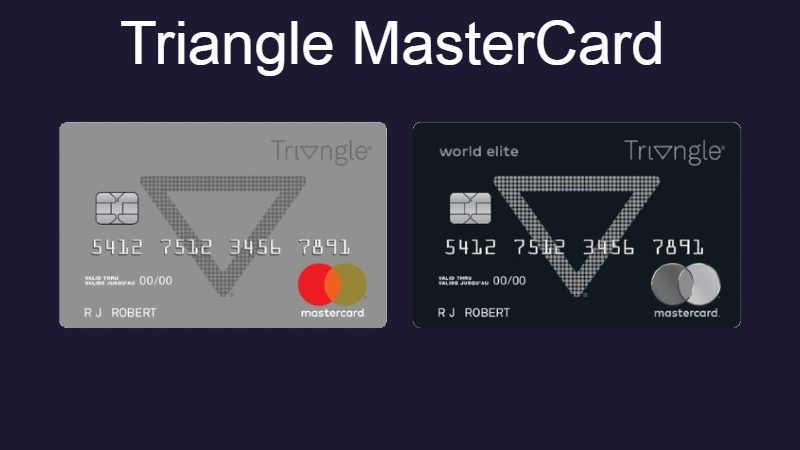

Triangle MasterCard Review

If you’re a frequent shopper at Canadian Tire and want to maximize your CT Money rewards, the Triangle Mastercard could be a valuable addition to your wallet. In this comprehensive review, we’ll delve into the features and benefits of the Triangle Mastercard and its premium counterpart, the Triangle World Elite Mastercard. These credit cards can enhance your CT Money earnings both in-store and online at Canadian Tire locations. Additionally, they offer potential savings at affiliated petrol stations, including Gas+ and select Husky stores.

IS THE TRIANGLE MASTERCARD A GENUINE CREDIT CARD?

Yes, the Triangle Mastercard is a legitimate credit card that can be used wherever Mastercards are accepted. The application process is straightforward, and you can complete it online within minutes. Notably, there’s no minimum credit score or annual income requirement to apply for this card.

WHAT CREDIT LIMIT DO YOU NEED FOR TRIANGLE MASTERCARD? TRIANGLE MASTERCARD CREDIT SCORE REQUIREMENTS

Your credit score, credit history, and previous interactions with other Canadian Tire credit cards all factor into determining your Triangle Mastercard’s credit limit. Once your application is approved, you’ll receive information about your specific credit limit. If you wish to increase it, you can contact CTFS toll-free, and their customer service representatives will assist you.

IS THE TRIANGLE MASTERCARD A GOOD CHOICE?

While the Triangle Mastercard is a decent card, there are more robust credit card options available in the Canadian market. If you don’t meet the income requirements for the Triangle World Elite, the Triangle Mastercard can be a viable choice. However, alternative credit cards with no annual fees may offer greater benefits and flexibility.

WHAT ARE THE BENEFITS OF A TRIANGLE MASTERCARD?

The Triangle Mastercard does offer some advantages worth considering:

Zero-Cost Financing: One standout feature is zero-cost financing, allowing you to pay off “qualified” purchases (minimum $150) made at Canadian Tire and affiliated retailers both in-store and online in monthly installments without incurring fees or interest.

Bill Payments: Unlike typical cashback cards, the Triangle Mastercard enables you to pay bills such as property taxes, water bills, education costs, and insurance premiums through Canadian Tire Bank. This can also earn you CT Money regularly when you use your credit card for these expenses.

Concierge Service: The Canadian Tire Travel Mastercard provides access to Mastercard’s “concierge service,” assisting you with travel plans, entertainment bookings, shopping, and business-related arrangements. It even offers medical support, helping you schedule appointments, visits, and prescription refills.

IS THERE AN APP FOR TRIANGLE MASTERCARD?

The Triangle App is available for free download, though it’s essential to note that regular carrier message and data fees may apply.

WHAT IS THE TRIANGLE MASTERCARD INTEREST RATE?

The Triangle Mastercard offers a compelling option for Canadian Tire shoppers with its attractive no annual fee structure. The variable purchase APR stands between 19.99% to 27.99%, and the card promotes a generous cashback of 4% in CT Money at partner retailers, with a notable 1.5% back at grocery stores, excluding some major chains, and 0.5% on other eligible purchases. Although it does not offer a welcome bonus, the lack of additional charges for purchases of $150 or more at participating retailers allows for interest-free payback in monthly installments. This card could be particularly appealing to those who frequent Canadian Tire and affiliated stations, yet some applicants might be swayed by alternative cards offering introductory incentives.

FOOD FOR THOUGHT

In conclusion, the Canadian Tire Triangle Mastercard offers a straightforward, fee-free credit card option that provides 4% cashback at Canadian Tire and 5% per-liter gas savings at affiliated Canadian Tire gas stations. While it has its merits, this card falls short in some critical areas and may not offer the extensive incentives and perks provided by other Canadian credit cards.

In terms of financial flexibility, the Triangle Mastercard credit limit is tailored to align with individual credit scores and financial histories, providing customers with personalized spending power. This personalized approach also extends to the Triangle World Elite Mastercard credit limit, which caters to customers seeking higher credit thresholds to match their spending needs. The World Elite version of the card, designed for those with a robust credit profile, not only offers an elevated credit limit but also includes additional perks such as enhanced roadside assistance and better earning rates for groceries, gas, and daily expenditures.

FAQs

1. What are the differences between the Triangle Mastercard and the Triangle World Elite Mastercard?

The Triangle Mastercard is suited for regular shoppers with no annual fee and basic benefits, whereas the Triangle World Elite Mastercard is targeted towards higher spenders, offering additional perks like roadside assistance and higher rewards on groceries and gas, but it comes with income requirements.

2. How does the Triangle Mastercard rewards program work?

The Triangle Mastercard rewards program allows you to earn Canadian Tire Money on everyday purchases – 4% at Canadian Tire and partner stores, 1.5% on groceries, and 0.5% on other eligible purchases. Rewards are redeemed as discounts on future purchases at Canadian Tire and other participating stores.

3. Can CT Money earned with the Triangle Mastercard be used for any purchase at Canadian Tire stores?

Yes, CT Money earned with the Triangle Mastercard can be used for most purchases at Canadian Tire stores, but there are exclusions like gift cards, hunting/fishing licenses, and services like auto service. It’s always a good idea to check the latest terms for any updates.

4. What are the eligibility requirements for the Triangle World Elite Mastercard?

To qualify for the Triangle World Elite Mastercard, applicants must meet certain income requirements – typically $80,000 for an individual or $150,000 for a household. You must also be a Canadian resident and the age of majority in your province or territory.

5. Are there any special financing offers available with the Triangle Mastercard?

Yes, the Triangle Mastercard offers special financing options called “no fee, no interest financing” on qualifying purchases of $150 or more at Canadian Tire and affiliated stores, allowing for repayment in monthly installments.

6. What kind of customer support does the Triangle Mastercard offer?

Triangle Mastercard holders have access to 24/7 customer service, which can assist with account management, troubleshooting, and answering any queries related to the card’s features or benefits.

7. How do the no-receipt returns work with the Triangle Mastercard?

If you paid with the Triangle Mastercard, you could return items without a receipt. This policy allows for hassle-free returns by verifying purchases through the card’s transaction history.

8. What additional benefits come with the Triangle World Elite Mastercard?

The Triangle World Elite Mastercard includes extra benefits such as roadside assistance, car rental insurance, and an increased earning rate for groceries and gas compared to the regular Triangle Mastercard.

9. How does the Triangle Mastercard compare to other no-fee credit cards in Canada?

While the Triangle Mastercard offers solid rewards for Canadian Tire shoppers, it may not provide as much value on everyday non-Canadian Tire purchases compared to other no-fee credit cards, which may offer broader cashback categories and additional insurances.

10. Can I use my Triangle Mastercard for international transactions?

Yes, the Triangle Mastercard can be used for international transactions wherever Mastercard is accepted, but be aware of foreign transaction fees that may apply, typically around 2.5% for the Triangle Mastercard.