Manage all your wealth in one app

The Prillionaires app represents the next generation of wealth management and personal finance software, facilitating real-time money management and secure multi-banking functionality all in one place. Users can manage and track investment portfolios, analyse market trends, monitor asset values, and utilise a net worth calculator.

Bank level security

Enjoy peace of mind with a protected and secure encrypted wealth management account, empowering new ways to access your financial institutions. Open banking, which is being rapidly adopted and implemented in Canada, is regulated to ensure safety and transparency.

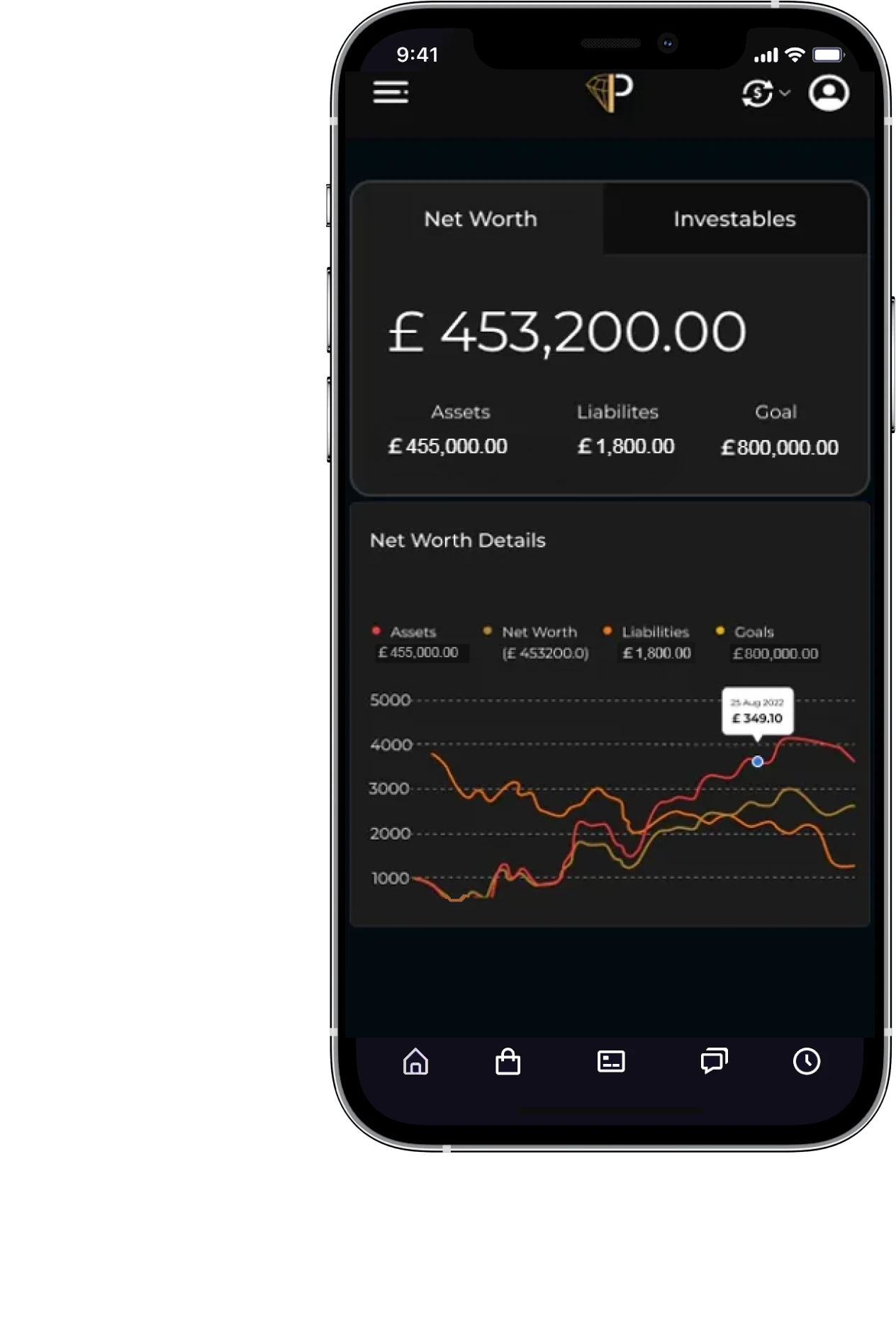

Net worth calculator

Prillionaires personal finance software is crafted to assist in assessing your financial position by estimating your net wealth. We gather comprehensive information regarding your assets and liabilities, provide up-to-date valuations of your property and vehicles, and automatically track your total net worth.

Wealth management app & Personal finance software

Who wants to be a Prillionaire ?

A prillionaire has multiple bank accounts, savings, loans, credit cards, retirement accounts, properties, car, stock and even different crypto wallets. Or they might not have them all yet, but they want a consolidated overview of their wealth from all over the place, in less than two minutes and they would like to track their total net worth.

Prillionaires Making Headlines

About Prillionaires Wealth management App

Don't have the time or resources to meet with a financial advisor in person? Discover Prillionaires, the top-rated personal finance software boasting bank-level security in Canada. With Prillionaires, managing multiple bank accounts, monitoring your financial assets and liabilities, and calculating your net worth has never been easier. Our user-friendly app also features multi-currency functionality and is accessible on both desktop and mobile devices, providing the flexibility to manage your finances on-the-go.

Multiple Online Banking

Wealth Management

Money Management

Net Worth Calculator

Prillionaires App's Stand-Out Features

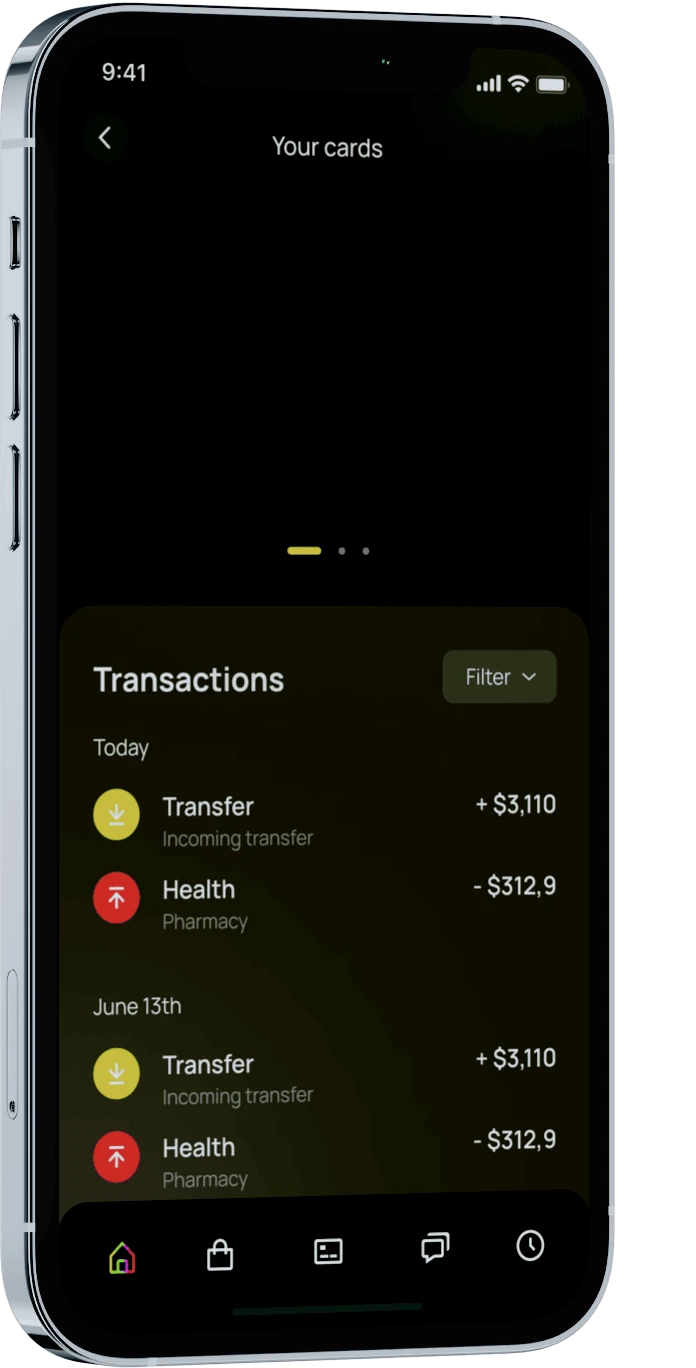

Manage all bank accounts from every country

Multiple banking: You can generate reports for transaction statistics and export them as CSV files prillionaires wealth management app provides you a transparent overview of all your linked monetary accounts as clear breakdowns of your month-to-month bills

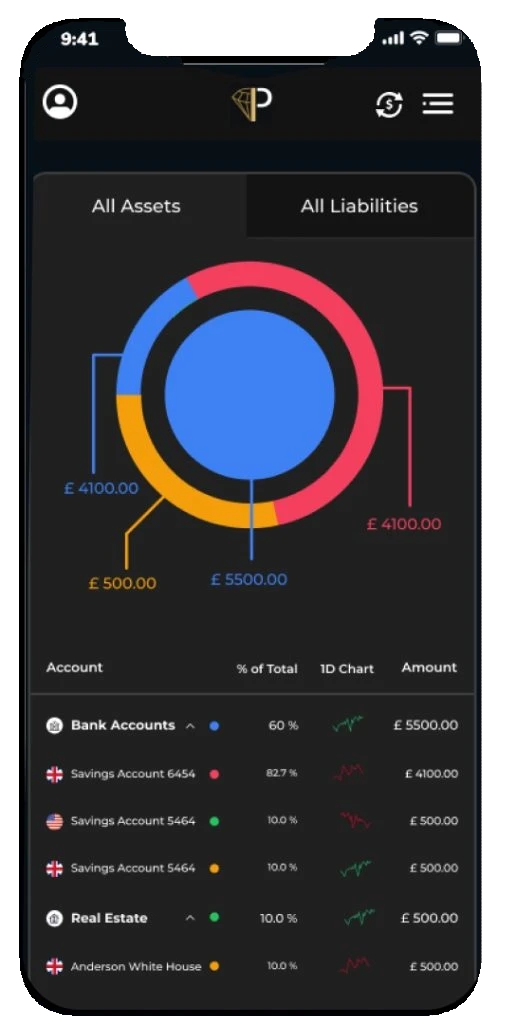

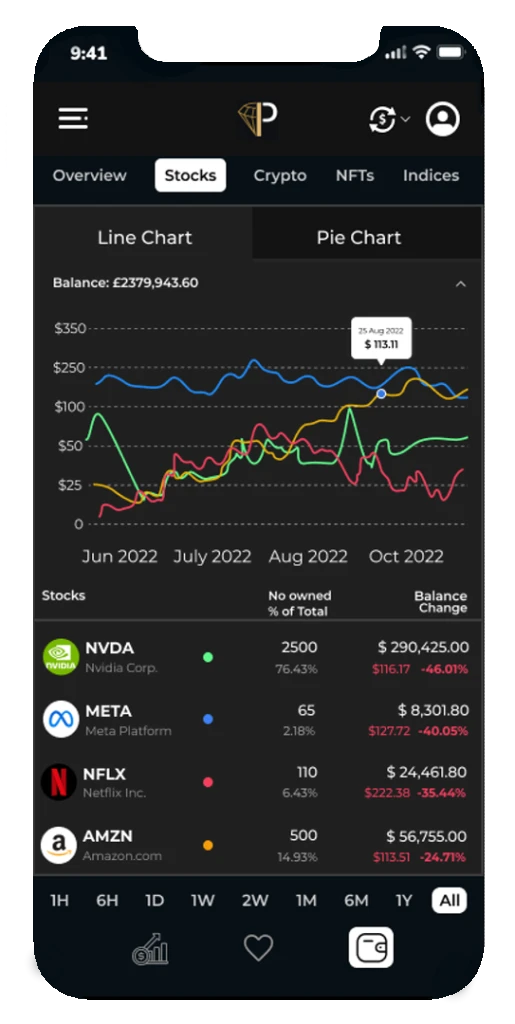

Track investments and brokerage accounts

Savings overview: Manage your investment accounts, choosing from standard brokerage accounts, retirement accounts, and education savings accounts. Add and monitor your loans, credit cards, and investment products all in one place.

Add your cryptocurrency wallet

Multiple wallets: Add and manage your multiple crypto wallets and your multi-currency wallet with the portfolio tracker in one place. Monitor your Ledger Nano S, Ledger Blue, Coinomi, Trezor, Freewallet, Exodus, Guarda, Atomic Wallet, Coinpayments, and more.

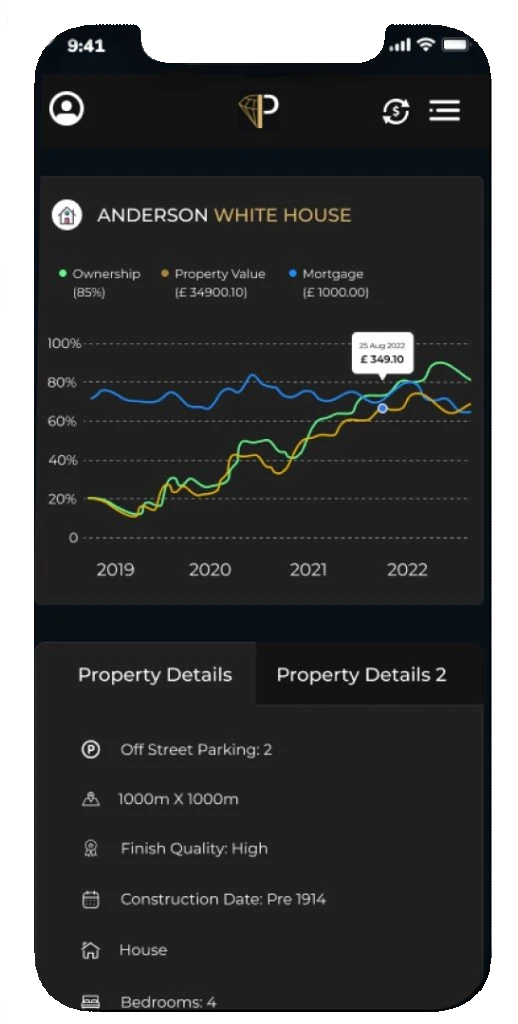

Monitor your properties and cars valuation

Net worth tracker: Unlock your future with digital wealth management. Get a transparent picture of your own assets and liabilities. Our wealth management app allows you to monitor the value of your property or car with the app’s net worth calculator.

Money management

By prioritising money management, you can lower your costs. You are more likely to keep track of your monthly outgoings, avoid hidden fees and charges, and invest extra funds wisely. With Prillionaires Wealth Management software, you can perfect your approach to money management and improve your financial success.

Clients are Loving Our App

I used to dread managing my bank accounts and cards but the Prillionaires wealth management app has made it easy. No more multiple logins in different applications, Citibank Bank of America and Ally. I especially love check my net worth, which gives me a clear picture of my family’s wealth. Highly recommended!

Sarah L.

MarketingI've always been a tech geek, but Prillionaires took my love for technology to a new level. Its intuitive design and real-time tracking of my various investments, including my crypto assets, have made financial management a breeze and almost fun! The future of personal finance app is here, and it's Prillionaires.

Mark T.

QA EngineerAs a busy mom juggling work and home, the Prillionaires personal finance software has been a godsend. The Multiple Banking feature lets me handle all my accounts in one place, saving precious time. This money management app doesn't just manage my finances; it manages my peace of mind.

Jessica B.

IllustratorI am one of the very early users of Prillionaires, and it has truly changed the way I approach my finances. With their property tracer, I have an up-to-date real estate portfolio value calculated in US Dollars, although not all houses are in America. I feel more confident about my financial future. Thank you, Prillionaires!

Michael P.

PR DirectorI have been using Prillionaires for a few months now, and I can't imagine going back to my old methods. Say goodbye to the Excel sheet; this app is a game-changer! Now, I am testing its portfolio tracker, and I was able to link my retirement account, brokerage, and crypto accounts. I can see the account balances in real-time, and there is a nice balance history graph where I can follow the growth. This is going to be a top-rated app soon!

Robert Mc. G.

Risk ManagerSIGN UP FOR OUR WAITING LIST TODAY!

Join the growing number of satisfied Prillionaires customer across Canada who trust Prillionaires to help them achieve their financial goals. Be the early adopter and get a head start with our cutting-edge application.

Any questions?

Check out the FAQs

Still have unanswered questions and need to get in touch?

PRILLIONAIRES HAVE 2 DEFINITIONS:

Definition 1: The group of people who have multiple bank accounts, savings, loans, credit cards, retirement accounts, properties, cars, stocks, and even different crypto wallets. Or they might not have them all yet, but they want a consolidated overview of their wealth from all over the place in less than two minutes, and they would like to track their total net worth.

Definition 2. The App; Prillionaires is a money management and wealth tracker app. It is able to organise your multiple assets and liabilities across borders, and calculate and track your total net worth.

Personal finance management software is a tool that helps individuals and households manage their finances by providing a comprehensive platform for budgeting, expense tracking, investment management, and financial planning. The software integrates all of your financial accounts, such as bank accounts, credit cards, and investment accounts, into one centralized platform, making it easier to track your spending, monitor your budget, and plan your finances effectively.

Fintech app usage in Canada shows significant variation across different age groups. Younger Canadians, particularly those aged 18-34, are the most active users, utilising these apps for budgeting, investing, and managing multiple bank accounts. Middle-aged Canadians, aged 35-54, also frequently use fintech apps for investment management and financial planning. Older Canadians, aged 55 and above, are increasingly adopting these technologies, primarily for secure online banking and expense tracking. These trends highlight the growing importance of personal finance software and wealth management apps in Canada.

Financial literacy in Canada generally correlates with educational attainment. Canadians with post-secondary education tend to have higher levels of financial literacy, understanding complex concepts such as investing, debt management, and budgeting more thoroughly. In contrast, those with only a high school education may have a more basic understanding of these financial principles. Various initiatives by the Canadian government and financial institutions aim to improve financial literacy across all education levels. Effective money management and the use of Prillionaires personal finance software can help enhance financial literacy.

In Canada, having multiple bank accounts does not directly impact your credit score. Credit scores are primarily influenced by factors such as credit history, outstanding debts, and repayment behaviour. Managing multiple accounts responsibly can help you organise your finances better and ensure timely payments, which indirectly supports a healthier credit score. Using Prillionaires wealth management app can assist in better money management and tracking of multiple accounts.

In Canada, deposits are insured by the Canada Deposit Insurance Corporation (CDIC) up to $100,000 per account holder, per insured category, at each member institution. To maximise protection, it is advisable not to exceed this amount in a single bank. If you have more than $100,000 in savings, consider spreading your funds across multiple banks or accounts to ensure all your money is covered by the CDIC insurance. Utilising Prillionaires personal finance software can help you keep track of your deposits and ensure they are within insured limits.